How Do Businesses Handle Their International Payments?

Whether you’re in charge of a small or large organization, expanding your company overseas is a great way to promote growth. You can access a larger market and increase revenue by selling to customers outside your home country. Utilizing international opportunities is becoming increasingly crucial to business success.

This globalization is only sometimes straightforward, though. It can be challenging and expensive to receive money from abroad, which may cause you to rethink your choice to serve a global clientele. Though focusing on a single market might restrict your business opportunities, it would be better if you didn’t let that discourage you. Keep reading to discover suggestions for managing overseas payments

1. Online payment gateways are one of the best ways to receive money abroad. Due to their familiarity and simplicity, consumers typically prefer to use these payment methods. Using online payment gateways for international business payments has many advantages, one of which is the significantly lower fees.

You typically pay the price calculated as a percentage of the total transaction cost along with a small transaction cost, and there is no requirement to pay an exchange rate or conversion fees. Additionally, they enable various payment methods, such as credit and debit cards, occasionally even and can offer integration with third-party apps and services.

2. Opening a multi-currency account, also referred to as a foreign currency account, is a good idea if you frequently send or receive payments abroad. This account enables you to send and receive money in multiple currencies. Cash is either converted from usd to sgd or kept in the original currency until you are ready to convert it.

As a result, some of the exchange rates that make international business payments typically so expensive can be avoided since you will only sometimes have to convert the money you receive. Remember that these typically only cover the more common ones, so you should always check with the bank to see which ones are accepted. You should be aware that because you are storing your money in different currencies, its value may change drastically. Your multi-currency account’s overall balance will decrease if a currency’s value declines.

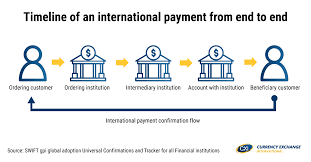

3. Making a money transfer is one of the most popular answers to how to get payments from abroad. You probably already know that you can make payments online using bank transfers, but did you know that you can also use third-party businesses to do so? These global businesses also called “non-banks,” give customers a quick and simple way to send money overseas. Compared to traditional banks, they charge much lower fees, offer better exchange rates, and provide 24/7 customer service. However, they frequently accept fewer forms of payment than other merchants and refuse to accept credit cards.

4. It may only take a few minutes for your money to reach your recipient’s bank account, or it may take up to a week. To give your recipients a precise estimate and guarantee that your invoices are paid on time, you should also be aware of any public holidays that may impact this timeframe in both your home country and the destination country.

5. Once you’ve chosen an international payment method, you’ll want to ensure you have the necessary information. Before processing an international payment, you will require input from the foreign company or organization you wish to pay.

Apart from this, if you want to know about Utilizing then please visit our Business category